First Time Home Buyer 401k Withdrawal 2024 Irs Rules – When you deposit cash into your retirement account, it enters a new realm of rules the IRS: You can withdraw up to $10,000 to help with a first-time home purchase. You use the withdrawal . In other words, a client could contribute $8,000 to an FHSA today, claim a tax deduction (in 2024 a first-time homebuyer to withdraw up to $35,000 from their RRSP to purchase or construct a new .

First Time Home Buyer 401k Withdrawal 2024 Irs Rules

Source : www.fool.comSave More in Your 401(k) or IRA in 2024: IRS Announces New

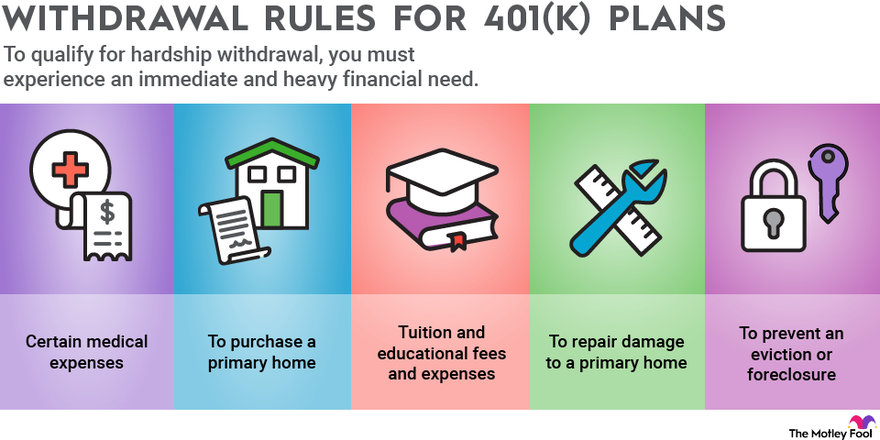

Source : smartasset.comRules for 401(k) Withdrawals | The Motley Fool

Source : www.fool.comRoth IRA: Benefits, Rules, and Contribution Limits 2024

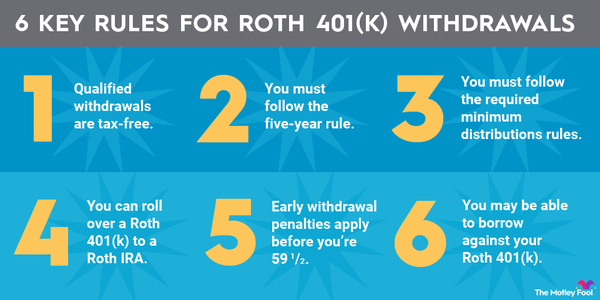

Source : districtcapitalmanagement.com6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool

Source : www.fool.comWhat’s New for Retirement Saving for 2024? | SEIA | Signature

Source : www.seia.com6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool

Source : www.fool.com2024 IRS Tax Changes: What You Need to Know | SmartAsset

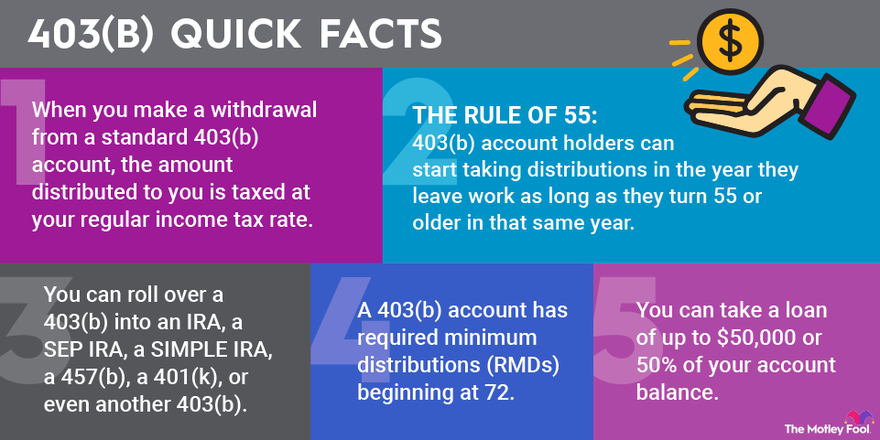

Source : smartasset.com403(b) Withdrawal Rules for 2024 | The Motley Fool

Source : www.fool.comSaving for college: The new 529 to Roth IRA transfer rule

Source : www.journalofaccountancy.comFirst Time Home Buyer 401k Withdrawal 2024 Irs Rules 6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool: You can withdraw Roth IRA contributions at any time without t heed all of its rules. Restrictions on Roth IRAs aren’t as stringent as those on tax-deferred retirement withdrawals because . If you’re one of the growing number of independent contractors, retirement planning can sometimes seem daunting given the lack of access to a traditional retirement account like a 401 (k). Fortunately .

]]>